We consider the utility of the real forward exchange rate as an investable valuation metric, focusing on a number of EM Latin American countries to demonstrate the application of the concept for a USD or GBP-based investor. We show why we think the metric is useful both as a gauge of all-in risk premiums, a guide to the timing of investments and as a way to consider the appropriate risk bucket for the underlying assets.

The real exchange rate adjusts for changes in the general level of prices between countries, thereby providing a tractable benchmark for currency pairs affected by a persistent imbalance in the level of inflation. In the same way that a forward exchange rate discounts interest differentials between countries over a certain period of time, a real forward exchange rate can be constructed using the combination of the real exchange rate and real interest rate differentials.

The chart below shows the concept for USDBRL. We rebase the spot real exchange rate to equal 100 in 2004, generating a real forward exchange rate based on the compounded real interest rate differentials between Brazil and the US.

At any point in time, what the measure captures is the ability for a holder of an inflation-linked bond in the US to sell the bond, exchange the dollar proceeds for Brazilian real and to use those proceeds to buy a Brazilian inflation-linked bond. The investor is compensated for increases in Brazilian CPI for the remaining lifetime of the bond, providing something of a cushion against declines in the nominal exchange rate, with the higher level of real yields compensating for a combination of higher default risk, greater return correlation to risky assets in economic downturns as well as the risk of a depreciation of the real exchange rate before the principal is repaid.

Although this is the purest application of the concept, regulatory constraints on many holders of inflation-linked bonds reduce the number of investors who would consider this type of transaction in practice. We therefore complement it with a simpler variant in which we show the combination of the real exchange rate and the real yield of the higher-yielding market. The resulting hybrid measure shows the protection for a cash investor in the lower-yielding currency assuming that their investment alternative would be to hold a zero real-yield asset in their domestic currency. In practice, this might either be too low or too high, depending on the domestic monetary policy regime in place, but the approach has the merit of isolating the contribution of the higher yielding asset to the investment decision. We label this hybrid measure ‘cash investor’s protection’ in the charts below.

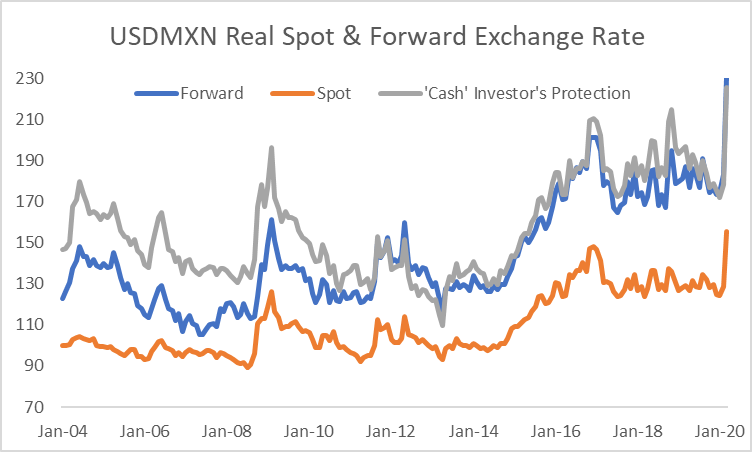

In the chart below, we show the application of the two concepts to USDMXN. The impact of the US monetary policy regime on the difference between the real forward exchange rate and the ‘cash investor’s protection’ is readily apparent: prior to the 2008 crisis when US real interest rates were consistently positive, the assumption of zero US real interest rates in calculation of the ‘cash investor’s protection’ has the effect of boosting that measure well above the forward. By contrast, post-crisis, with US real interest rates close to zero most of the time, the difference between the two metrics has typically become relatively modest.

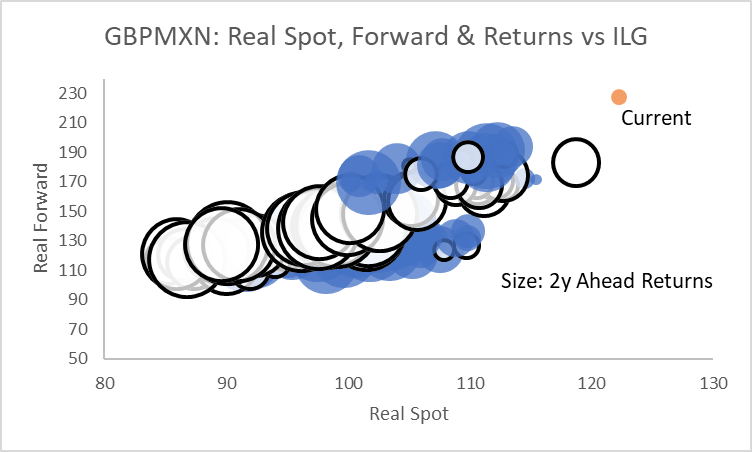

In the UK, because the impact of regulation on investor behaviour has become increasingly influential in depressing inflation-linked yields relative to other countries, the difference between the two measures has, by contrast, become increasingly substantial.

The chart above is also notable for the fact that the GBPMXN real exchange rate has exhibited far greater stability than the USDMXN real exchange rate.

We consider two primary drivers of the real exchange rate: the first is productivity, given the expectation that low income countries will experience faster domestic services inflation as their productivity rises and income levels converge with higher income countries; the second is current and expected terms of trade, particularly for countries with high exposure to commodities.

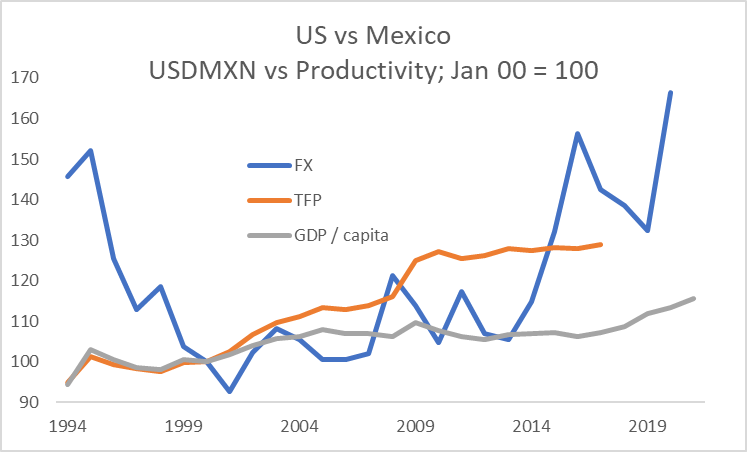

The chart below compares the USDMXN real exchange rate with two measures of productivity: the first is based on Total Factor Productivity growth differentials as reported in the Penn World Tables while the second shows changes in GDP per capita at PPP exchange rates, as reported by the IMF.

Depending on the metric used, over the period since 2000, the US has seen an improvement of productivity versus Mexico of 15-30%. As of the end of April 2020, the USDMXN real exchange rate had appreciated by just over 65% since 2000. The extent of the peso’s depreciation likely reflects some combination of market judgment that sustainedly lower oil prices may require a weaker Mexican real exchange rate relative to its historic level as well as the discount required on all riskier assets during a period of extreme uncertainty over activity and income levels.

We show two ways of evaluating performance.

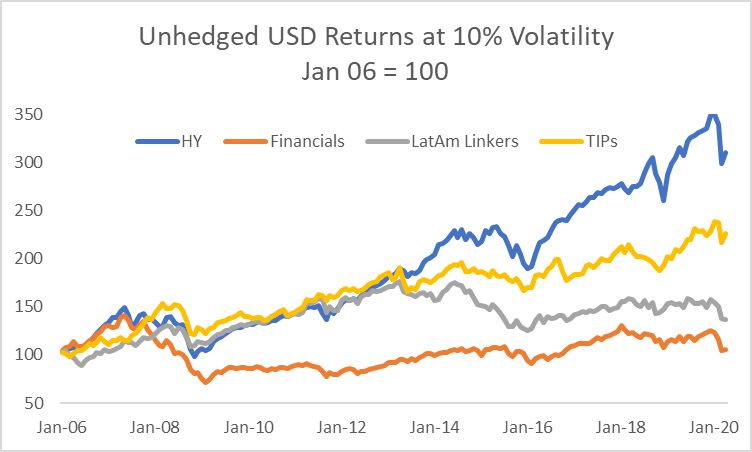

For the first, we construct an equally-weighted index based on Mexican, Brazilian and Chilean inflation-linked bonds, using the returns from the Barclays indices. Considering all the assets at 10% volatility, we then compare the returns with US TIPS, US High Yield credit and the MSCI World financials index, all expressed in unhedged USD terms.

We can make three clear observations from the returns history:

- All of the assets saw a substantial repricing during the 2008 crisis; in contrast to the others, global financials struggled to recover as capital needs and the regulatory costs associated with the business increased (less apparent from the chart but nonetheless the case is that LatAm linkers have delivered a similar return profile at 10% volatility to global financials since 2016);

- Until 2013-2014, the return profile for LatAm inflation-linked bonds in USD terms was readily comparable with US High Yield and TIPS; the subsequent bifurcation likely reflected a combination of (I) the end of China’s commodity binge, (II) the oil market collapse in 2015; (III) Brazil’s financial crisis, and (IV) the upward shift in USD real rates and the dollar itself as the Fed moved away from emergency settings for interest rates and US fiscal policy become highly stimulatory under President Trump;

- Even allowing for the occasionally large drawdowns, the returns from leveraged US credit have been competitive with almost all other major asset classes through the period.

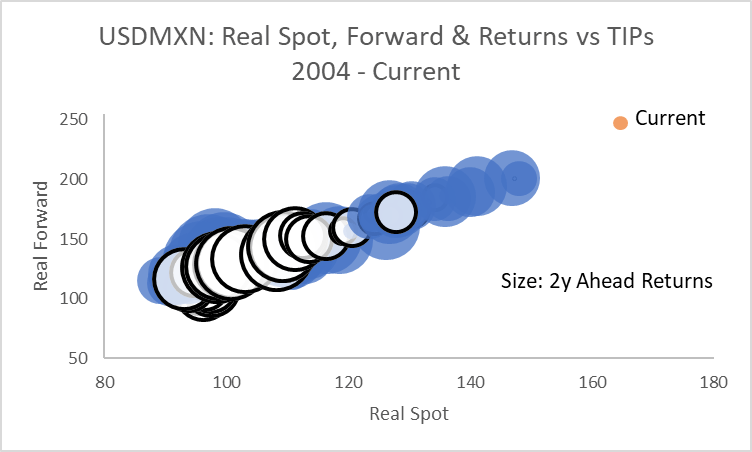

Instead of constant exposure to the asset class, we now consider the merits of using the forward real exchange rate as a valuation indicator. In the charts below, we show two different investment cases for a USD-based and a GBP-based investor:

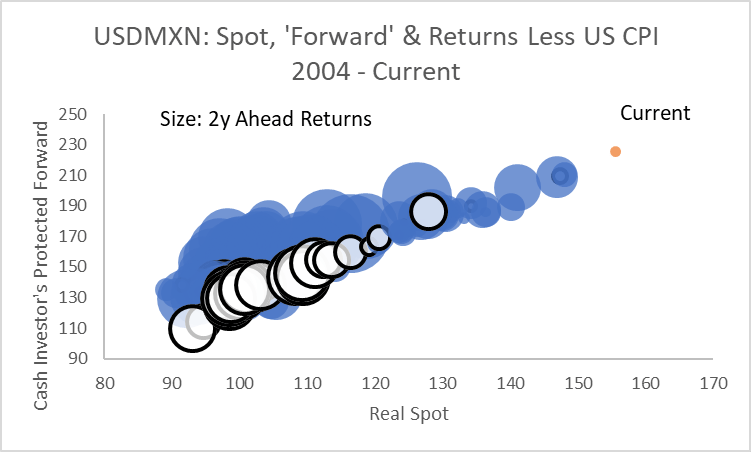

- In the first case, we show unhedged Mexican inflation-linked bond returns less US or UK CPI relative to the real spot exchange rate and the ‘cash investor’s protection’ rate as an indication of whether Mexican inflation-linked bonds delivered a positive return in real USD or GBP terms over the subsequent two year period (we selected two years in all cases as an indicative period for mean-reversion of the real exchange rate and reduction in risk premiums through the cycle, making no attempt to optimise the holding period);

- In the second case, using the real spot and forward exchange rates, we consider the more challenging hurdle of whether Mexican inflation-linked bonds outperformed domestic inflation-linked bonds over the subsequent two year period.

The two charts below show the case for a US-based investor. The blue bubbles indicative a positive return over US CPI for a USD-based investor, the white bubbles a negative return. Given a two year investment period, the clear indication from the chart is that the combination of the real spot and forward rate helps to identify the conditions under which positive returns in real USD terms are more likely to be delivered. The ‘Current’ point in each of the remaining charts refers to end-April 2020.

By contrast, it is less apparent whether the construct is useful in identifying whether Mexican inflation-linked bonds will outperform TIPS in unhedged USD terms.

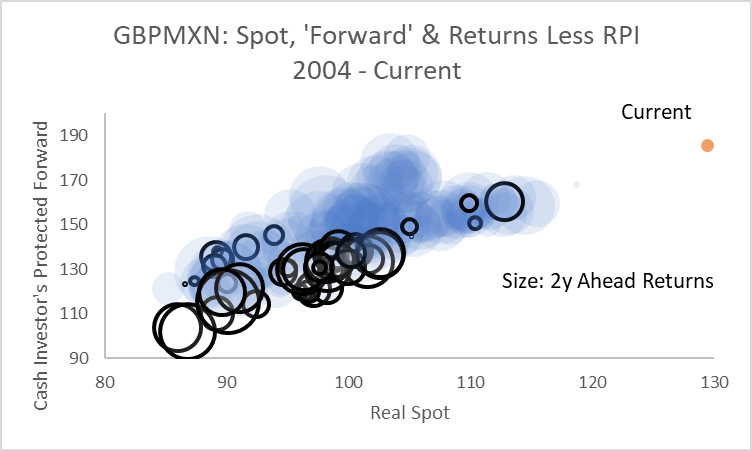

These conclusions are reinforced when extending the analysis for a GBP-based investor.

Because the GBPMXN real exchange rate has been largely stable, the combination of the real spot and ‘cash investor’s protection’ rate have helped identify the conditions under which Mexican inflation-linked bonds are likely to deliver a positive return in real GBP terms over the subsequent two years.

However, over the period considered, it has almost always been a losing proposition to sell inflation-linked gilts relative to Mexican inflation-linked bonds, regardless of the starting-point for the real exchange rate.

This analysis helps draw out a number of different components of the investment decision for EM inflation-linked bonds:

- EM inflation-linked bonds can deliver competitive returns for foreign investors;

- However, for many G10 investors, they are best considered as part of the risky asset bucket – they cannot compete with long duration domestic bonds in an environment of deteriorating growth;

- Similar to risky assets overall, a dynamic approach is best in determining the appropriate level of exposure through the cycle;

- Analysis of the real exchange rate and appropriately-defined forwards has historically helped define the conditions under which these assets are most likely to perform;

- Nonetheless, this does not do away with idiosyncratic policy decisions or risks from sudden institutional changes;

- Looking forward, an investor’s judgment on the drivers of the real exchange rate and the outlook for an individual country’s creditworthiness can be used to help determine whether the compensation for risk offered by current entry points are sufficiently attractive or not.

The commentary contained in the above article does not constitute an offer or a solicitation, or a recommendation to implement or liquidate an investment or to carry out any other transaction. It should not be used as a basis for any investment decision or other decision. Any investment decision should be based on appropriate professional advice specific to your needs.