We explore the merits of different approaches to tracking carbon as a source of returns in a macro portfolio, concentrating on equity and FX markets.

Whereas the sector concentration of CO2 emissions makes it relatively easy to identify a high-level carbon factor in equities, FX is more challenging. We expose the ways in which construction of a carbon FX portfolio requires the integration of EM currencies and therefore careful risk management of non-carbon factors.

Our intention is to build towards a cross-asset expression of carbon in a macro portfolio. The approach we use is to identify summary financial exposures that an investor can monitor in expressing carbon as a theme and to define those exposures parsimoniously.

In starting, we summarise the building blocks we use in constructing a theme using asset returns:

- Themes are designed to give constant exposure to a driver of asset returns;

- They an be comprised of outright or long/short asset exposures;

- They are constructed such that each exposure has 10% volatility to prevent returns from higher volatility assets dominating the signals from lower volatility assets;

- The investor has constant exposure to a theme regardless of prior losses or profits made;

- Representations are designed to be generic to capture the essence of the return stream rather than favouring niche expressions that may be dominated by idiosyncratic factors.

Taking a well-known example in the form of cyclical assets to demonstrate one set of applications of the approach:

- Cyclical upswings are periods of increased economic optimism, rising demand for capital and growing willingness to take market risk;

- Hence, in a cyclical upswing, real interest rates would typically be expected to come under upward pressure;

- Inflation expectations generally rise in phases of cyclical strength;

- Equities would usually be expected to outperform bonds;

- Credit spreads would normally compress;

- High-yielding currencies would typically outperform low-yielding currencies.

Hence, in the cyclicals theme whose returns we show later, the investor is short inflation-linked bonds, long breakevens, long equities versus Treasuries, long credit, long the cyclical component of the equity market as well as long high-yielding currencies funded in safe-haven currencies. This is not necessarily the best combination for all cyclical upswings or indeed all parts of an upswing. However, it serves to capture a generic cyclical momentum across markets.

Taking this as a base, what considerations should inform our thinking about carbon in a macro portfolio?

- Although policy change to achieve carbon-reduction targets over time could have very significant implications for asset allocation decisions and desired country exposures, we think it easiest, in the first instance, to consider carbon as a relative price factor;

- In particular, policy is increasingly oriented towards encouraging the market to devalue activities that are intense in carbon production relative to those that are not;

- Hence, we focus on a series of long/short exposures: investors are long low carbon-producing sectors relative to carbon-intense sectors while being long currencies of low emitters or of economies in which activities have adjusted to a price of carbon consistent with public policy objectives;

- We use OECD data to isolate the carbon intense sectors (utilities, oil and gas along with metals and mining) and define exposure such that the investor is short those sectors relative to the MSCI World.

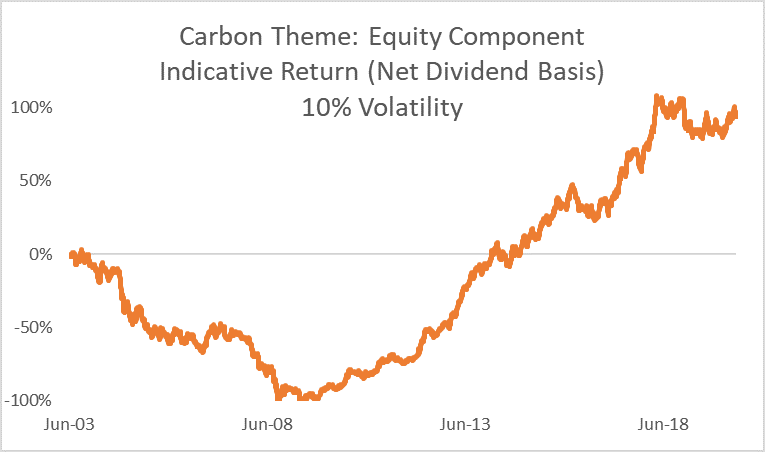

The chart below shows the summary return stream from this long/short equity exposure:

The chart identifies two very distinct periods for the exposure:

- Through the commodity super-cycle, the strategy was disastrous: the strength of China’s demand for commodities caused the market to judge that income streams from carbon-producing sectors were increasingly valuable, the opposite of what the strategy seeks to gain exposure to;

- By the start of the 2010s, however, the cycle turned and, as China’s dash for commodity-intensive growth abated, so did the relative weight of carbon-producing sectors in global equity markets;

- The result was a return history for the strategy of large extremes.

To identify potential candidates for expressing the same theme in FX, we adopted a metric based on CO2 emissions relative to per capita GDP. The chart below shows, for selected countries, that the relative country rankings are stable even though the overall level of emissions per unit of GDP have trended lower.

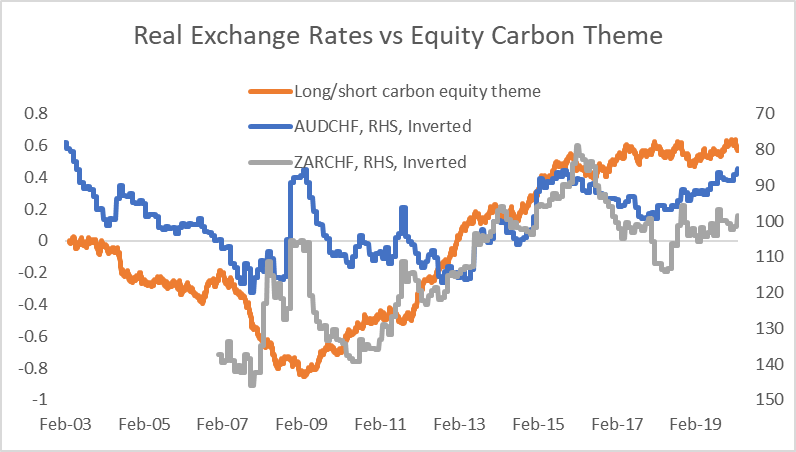

Taking the extremes from this group of countries to allow a long/short portfolio to be structured, we first consider the relationship between the relative price of carbon as measured by equity market returns and FX.

The chart shows that there is a long run relationship between the real exchange rates of the chosen pairs and the equity theme. Indeed, this is a well known channel in FX analysis: given that both Australia and South Africa are commodity exporters, while Switzerland is a commodity importer, we would expect that the equity returns embedded in the carbon equity theme would act as a proxy for the terms of trade in commodities.

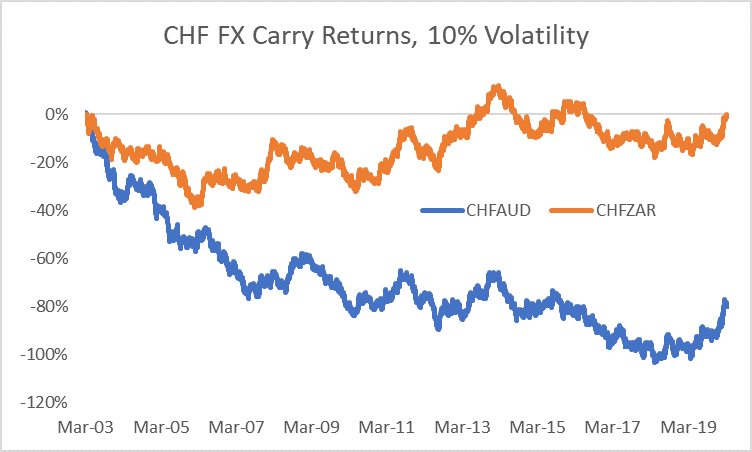

Regrettably, this is not sufficient for the construction of a profitable FX strategy, however. As shown in the chart below, the persistently higher level of interest rates in Australia and South Africa compared with Switzerland either neutralise or dominate the prospective long run return stream coming from the relative pricing of carbon.

We adopt two approaches in seeking to address these problems:

- We use more recent and detailed metrics for assessing countries’ carbon exposure; and

- We actively seek to control for non-carbon risks using a portfolio of both developed (DM) and emerging market (EM) currencies.

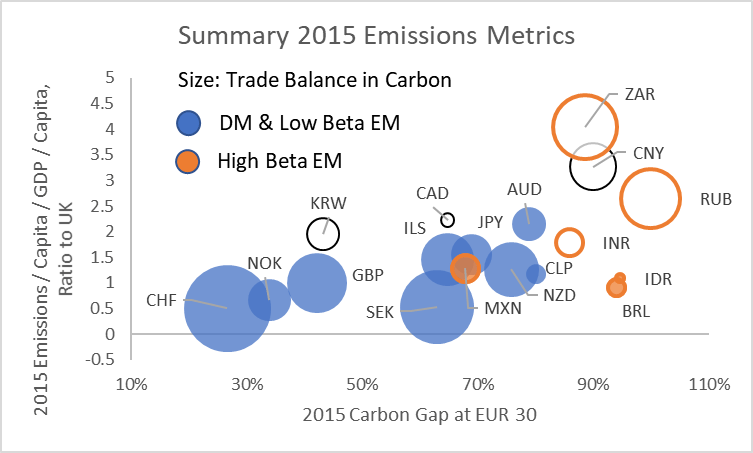

The chart below summarises a number of metrics compiled by the OECD on carbon emissions.

The chart displays the following:

- The x-axis shows the OECD’s measure of the carbon gap: a way of measuring the proportion of economic activity within a country that reflects carbon prices at or above certain levels judged to be consistent with long run climate pledges – the lower the gap, the more competitive is economic activity in a country assuming that carbon prices adjust to the level required to contain global warming;

- The y-axis shows emissions per capita, with all countries shown as a ratio to the UK purely for the purpose of easy visual comparison;

- The size of the bubbles shows the OECD’s estimate of whether a country is a carbon exporter (bubbles with a white centre) or importer (coloured) as embedded in the goods it trades – the size of the bubble shows the size of the country’s exposure to net trade;

- Finally, we distinguish high beta EM currencies from other currencies because they typically suffer both weaker currencies and higher interest rates in a period of risk aversion, thereby creating a higher volatility return structure.

How might we consider these metrics in forming a carbon FX portfolio?

- First, early adjustment to higher carbon prices should, in principle, be a source of competitive advantage, with those countries standing to benefit as policies in other countries converge over time;

- Second, large net exporters of carbon embedded in goods trade are prospectively particularly exposed to changes in other countries’ policies regarding carbon pricing, eg through carbon border taxes;

- Third, any meaningful FX portfolio exposure to carbon needs to consider how to manage EM risk.

In addition to these considerations, the approach we take seeks to adjust to the natural grains of the FX market:

- We select currencies such that the portfolio has no net dollar exposure given the dominance of the dollar factor in pricing currency risk independent of carbon exposure;

- We seek to limit exposure to managed currencies and in particular elect not to include China in the portfolios because of the amplified effect its currency moves can have on other EM currencies;

- We seek to balance out risk exposure between currency pairs with otherwise similar risk exposures, eg to safe haven flows, carry, cyclical risk or EM beta risk;

- Nonetheless, investors should bear in mind that EM assets naturally reflect a higher level of idiosyncratic risk than DM and that this may periodically overwhelm the desired carbon exposure.

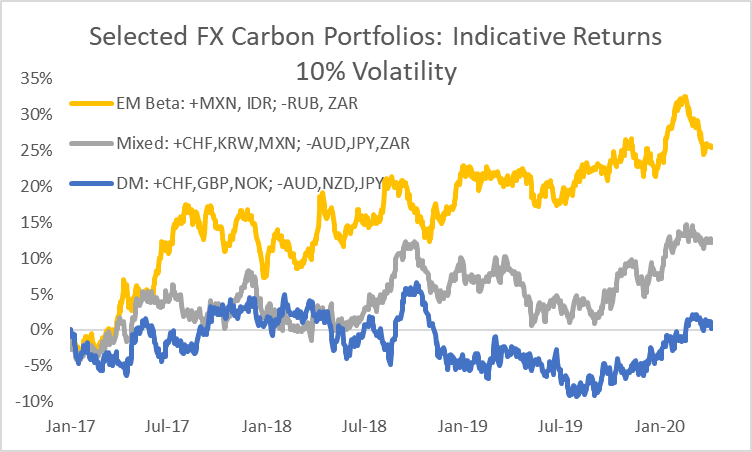

The chart below summarises the performance of three different portfolios. The portfolios are based on slow-moving information that is published with a long lag, hence returns should be treated as purely indicative, with the merit of the inputs in selecting currency exposure better gauged over the coming economic cycle. Some investors may seek to implement an active management overlay to allow, for example, within-bucket risk reallocation based on other valuation metrics whilst retaining the same directional exposure to carbon.

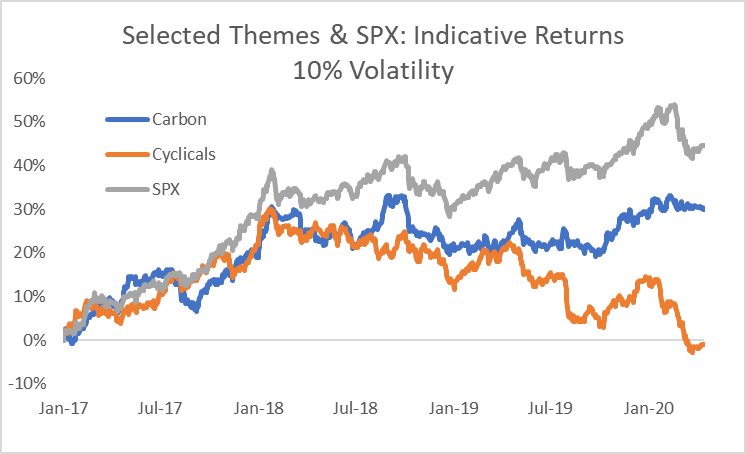

Finally, we combine the mixed FX portfolio with the equities carbon theme shown above to demonstrate the concept of a cross-asset carbon theme, comparing the resulting return streams in comparison with our cyclicals theme and the S&P 500, all at 10% volatility.