Navigating the intersection between price and value

“What’s in the price?” is a common question for investors. It means, “What expectations for future events are discounted in the current price?” But, in times of crisis, it pays to take a step back and ask a more basic question, “What really is the price for?”

- Normal assumptions about market depth or the extent to which a transaction might influence market prices break down;

- Relationships between normally closely-linked assets are undermined as extreme levels of volatility or balance sheet constraint remove the capacity to arbitrage;

- Perhaps most strikingly, we see that the price of assets embedded in an institutional structure can be wildly different if the liquidity of the structure and the assets diverge.

For a time, the price of liquidity comes to dominate any other market signal.

Updating some analysis I co-authored with Honglin Jiang and Bill Papadakis in 2015 helps to show this.

Closed end funds are designed to capture a particular investment theme or segment of the market. The fund manager issues a fixed number of shares and uses the proceeds to invest in securities according to the mandate of the fund. Arbitrage-free pricing would suggest that the price of the fund should align with the net asset value of its securities. However, in practice, this relationship is subject to significant change through time, with sizeable discounts evident during periods of extreme market uncertainty, as at present.

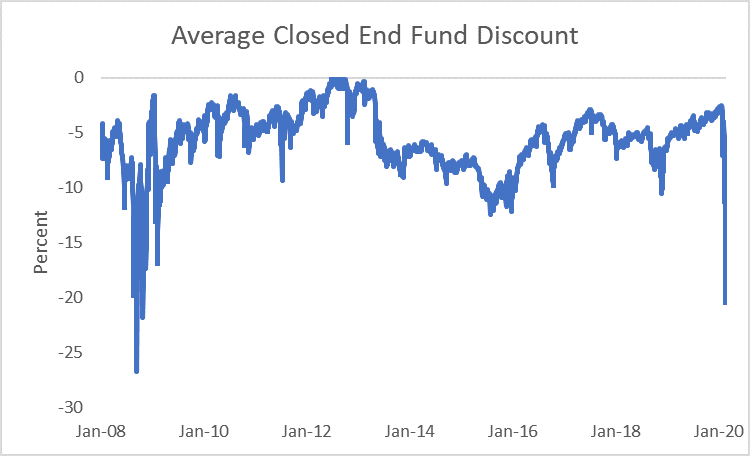

In our earlier analysis, we considered 50 funds representative of the closed end sector as a whole with more than five years of price history as of 2015. Taking the same funds as used in the original analysis (with the exception of a couple which had been bought out in the intervening period) shows that the average discount during the last week was similar to the most extreme points of the 2008 crisis.

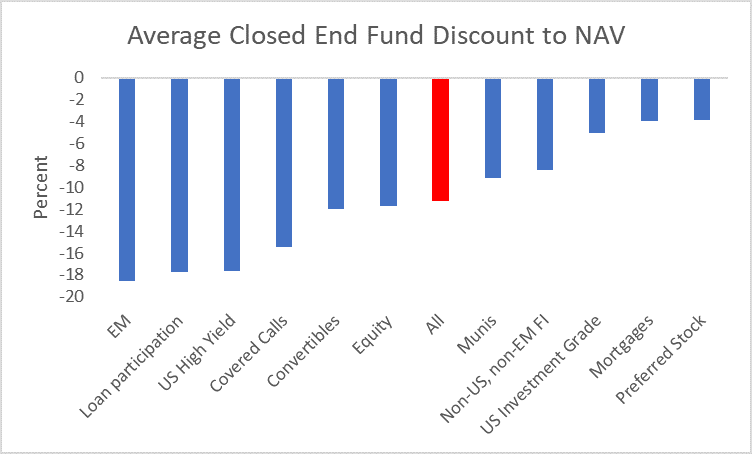

It would be wrong to see this extreme bifurcation between the price of assets as marked in the market and as signalled by the price of the closed end funds themselves as a sign of random malfunction. Instead, the sectors with the largest divergences in prices are the ones where assets are most likely not to be trading or where uncertainty over the sustainability of income streams as a result of the shock from the coronavirus is greatest.

This can be seen, for instance, in abnormally large difference between the discounts for US Investment Grade funds and those for High Yield funds.

Hence, the price signal from the discounts in closed end fund is twofold:

- It is a signal of the price of liquidity today, and

- A signal of the location of potential future value if macro conditions improve

The commentary contained in the above article does not constitute an offer or a solicitation, or a recommendation to implement or liquidate an investment or to carry out any other transaction. It should not be used as a basis for any investment decision or other decision. Any investment decision should be based on appropriate professional advice specific to your needs.